Given the emphasis on ESG in the media and among the finance community one could easily believe that capital markets are a major contributor to the goal of limiting global warming. We argue this perception is largely false; a narrative strongly pushed by the finance industry to highlight green initiatives and in so doing, block further (potentially profit-reducing) regulation.

The basic economic idea behind green or sustainable investment assumes that “green” investors derive utility from both, the financial gains they earn holding the firms’ shares, and from the positive social or environmental impact of these firms. For instance, investors could start buying shares of wind farms, despite the fact that they are less profitable than coal-burning energy firms. The wind farms would then experience a (one-off) share price increase which is associated with lower financing costs, allowing further green investments. Investors would happily accept lower financial returns.

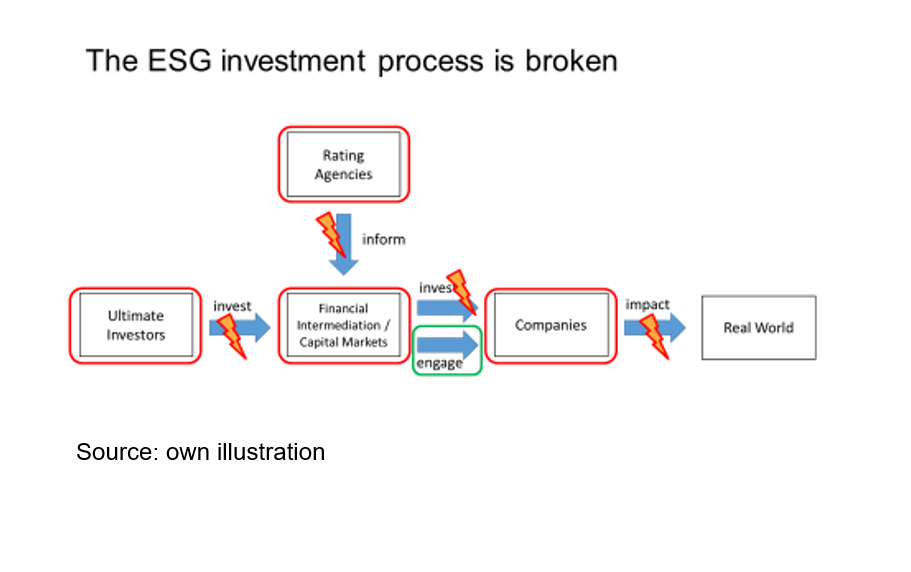

We analyze the ESG investment process at the micro level: Households are ultimate investors that use some sort of financial intermediaries, such as banks, or mutual funds. These in turn use ESG ratings either produced inhouse or from rating agencies to inform their investment decisions. They then give loans to firms, or buy shares or bonds from firms to deliver (mostly financial) returns to the ultimate investors and to earn their fees. The newly acquired green funding allows firms to change their behavior – e.g., reduce their CO2 footprint in production – and thus help mitigate global warming.

Recent research has found, however, that this process is broken in various places:

Many green investors are less interested in the impact of their investments in terms of CO2 reduction, but more in the good feeling derived from investing in green assets (“warm glow”). Authors from the Hong Kong Monetary Authority have asked, “How much is the world willing to pay to save the Earth?” and concluded, “Sadly, not much”. For instance, there is little difference between the returns of green and traditional bonds on average. Green is allowed to hurt a little, but not much in terms of financial returns.

Asset managers love to label their funds “green” or “sustainable” – because this ensures higher demand and higher fees for otherwise mostly identical funds. As an insider put it, one firm “reports externally that a large part of the investments are in ESG-compliant investment strategies, but explains internally that it is only a fraction. […] The sustainability propaganda and rhetoric of [the firm], but also of other financial institutions, got completely out of control.”

Rating agencies are central to the ESG investment process as they are a key source of information for creating investment products and for making investment decisions. However, their ratings of the same firms differ widely, and what they measure is mostly the risk the firms experience from future regulation, not the risk that the earth’s climate experiences from further operation of the firms.

Finally, green investments only make a difference to climate change if the investment would not have been done without the green funding: If a new refrigerator is environmentally better than the old one and pays off by saving money due to lower energy consumption then a firm will buy it, no matter whether the funds used are labeled green or not. This “additionality” is key as the green funding needs to cause environmentally friendly activity, or otherwise nothing changes. Based on close to zero return differences to conventional products, not much impact on the real world can be expected.

As a result, green finance is more accurately seen as a source of additional fees for the finance industry rather than a means of actual CO2 reduction (or similar good things for the environment). However, few of the people involved seem to care: Investors feel good, ESG rating agencies come into being and flourish, accountants, commercial and investment banks, asset managers etc. prosper, companies get (slightly) cheaper funding and a better image. Regulators are busy, politicians can showcase action and change, and last but not least, business schools are able to offer green investment classes, heart-warming case studies and a good conscience. Everybody is happy. Only one thing is decidedly unimpressed: the earth’s temperature, which continues to rise.

We should stop waiting for the capital markets to do their magic with “sustainable finance” and instead focus on regulating firms’ actions and emissions directly.