—Dariusz Wójcik, Eric Knight, Phillip O’Neill and Vladimír Pažitka—

Investment banks have been powerful financial institutions at least since the late 19th century. Their power stems from their role as the key financiers and advisers of corporations and governments, giving them privileged access to information, the main resource in global financial markets alongside talent, which they also attracted successfully with fast-track careers and large bonuses. This power reached new heights in the late 1990s and early 2000s, as investment banks found themselves in the thick of globalisation and financialisation of the world economy. By inventing and/or popularising such concepts as shareholder value, value at risk, BRICs (Brazil, China, India, Russia) and emerging economies, investment banks have shaped the very way we look at the global economy and measure economic performance.

This bonanza came to an abrupt end in September 2008, when Lehman Brothers, one of the biggest US investment banks, went bankrupt under the pressure of toxic financial instruments, invented and created by the bank itself and others in the sector. Within weeks, the whole investment banking species around the world was in danger of extinction, saved only by government bail-outs, and injections of new capital from investors (often in the Near and Far East). The species survived, but what is its shape and structure now? How has it changed and with what implications for the world economy?

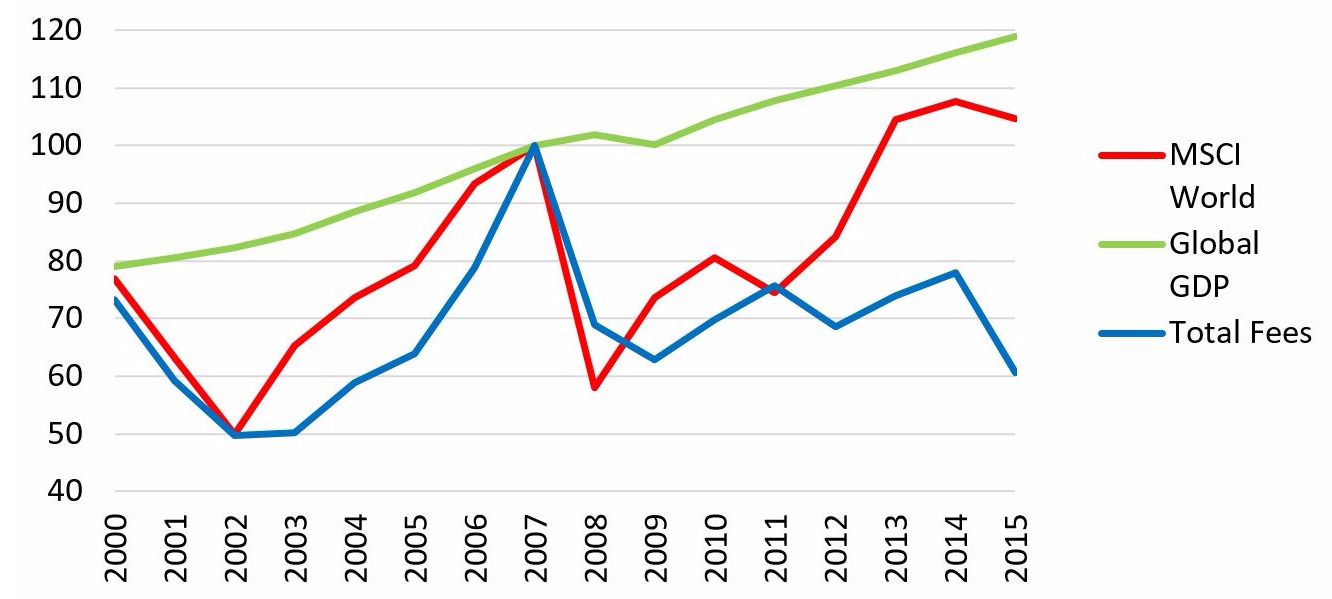

In this paper we use worldwide data on capital market transactions from Dealogic to investigate the size, institutional as well as geographical structure of investment banking industry in the wake of the global financial crisis. First of all, we find that by 2015, the total revenues of investment banks from capital market activities have shrunk to only 60% of their 2007 level. Moreover, at least by 2015 there were no signs of these revenues recovering in line with the recovery of stock markets in recent years, which suggests that the shrinkage of investment banking is a long-term rather than a temporary trend.

Total fees in investment banking in relation to global GDP and MSCI World stock market index (2007 = 100)

Source: authors based on data from Dealogic, MSCI and the IMF

Secondly, the hierarchy of investment banks have become much flatter. The largest investment banks, including Goldman Sachs, Morgan Stanley, Citi, Deutsche Bank, Credit Suisse and UBS, have downsized their activities most, while those playing only in the ‘second league’ before 2008, such as HSBC, Wells Fargo, Jeffries, Societe Generale or Nomura and Mitsubishi UFJ, have even expanded. While the whole market has contracted, smaller companies have been gaining market shares from the giants. This is most likely the effect of international and domestic financial regulations targeting large systemically important banks. It may also represent good news in terms of increased levels of competition.

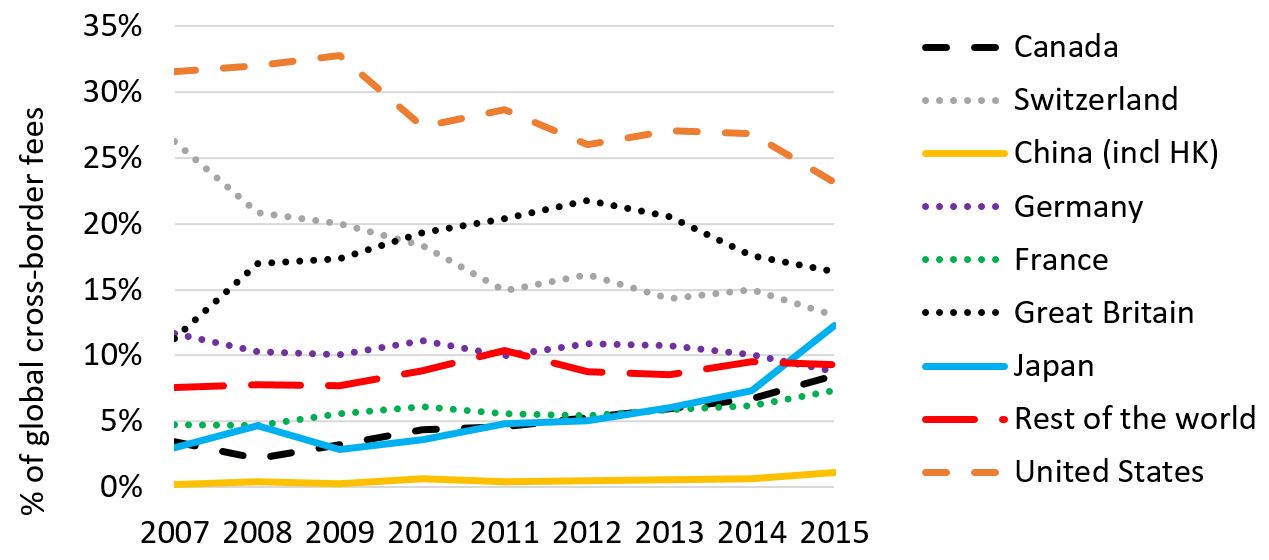

Thirdly, while US banks continue to dominate due to their sheer size of the US capital market, their dominance in cross-border investment banking services has diminished. The main losers, however, have been the Swiss banks, who have downscaled investment banking on an unprecedented scale and shifted attention to wealth management. The main winners, so far, seem to be the Japanese banks, affected little by the crisis of 2008, and capitalising on the recent wave of foreign investment by Japanese firms. Those expecting a big entry of Chinese investment banks on the stage, should not hold their breath. We still seem to be a long way from the emergence of a Chinese Goldman Sachs, if it is ever to happen.

Market shares of investment banks by nationality. Source: Authors based on data from Dealogic

Market shares of investment banks by nationality. Source: Authors based on data from Dealogic

Overall, investment banking industry is now less geographically concentrated than it was before the crisis. This should be good news. Though their power is diminished, investment banks are not going to disappear. The more diverse their national bases, workforces, and worldviews, the more diverse and pluralistic the global financial system.